By Brenna Garratt and Bryan Jenkins

Many leaders sense branding is important, but some struggle to measure its impact. Still, brand can have compounding effects across a high-growth business, as it can be a driver and a reflection of performance.

Regardless of where you are in the company lifecycle, it’s never too late to invest in brand. And, if executed properly, the strategic investment can pay substantial dividends in near and long-term growth.

Below, we share a typical PE-backed portfolio company case study to illustrate how a stronger brand can translate into greater returns for organic growth, talent retention, and valuation.

WATCH THE WEBINAR

Learn more about leveraging brand for greater financial impact

Growth challenges for PE-backed portcos

Aspiring market leaders need to balance the following priorities while scaling

Position the company to stand out

Differentiation can remove friction in the sales funnel.

Drive awareness and generate leads

Portcos need to successfully drive clients through their sales funnel for awareness, engagement, and lead generation.

Showcase new offerings

Organizing the architecture of products and services makes selling to the right buyer easier.

Exploit market trends

Portfolio companies need to anticipate changes in the market and drive those changes.

Be an employer of choice

Recruiting and retaining talent are critical efforts when scaling a portfolio company.

Justify pricing

It’s essential to get your pricing right and to leverage brand to validate the pricing.

Common brand misconceptions

As consumers, we all know what a brand is. Often, we associate a brand with its visual elements (such as logos and brand colors). However, the brand’s foundation lies beneath the surface and includes strategic components such as your market positioning, value proposition, and core messages. The essence of a brand is in its purpose and a consistent narrative that aligns internal stakeholders, customers, and the market.

How brand awareness and equity are often measured

Common marketing metrics focus on tactical inputs and often miss the mark in measuring key business outcomes.

- Web traffic

- Branded search volume

- Mentions: PR, analyst reports, social

- Video metrics

- Overall revenue/leads increase

- Social media

- Full funnel metrics

These metrics are not inherently bad but are a means to an end. It’s easy to get lost in seemingly tangible inputs. Driving key business outcomes matters more.

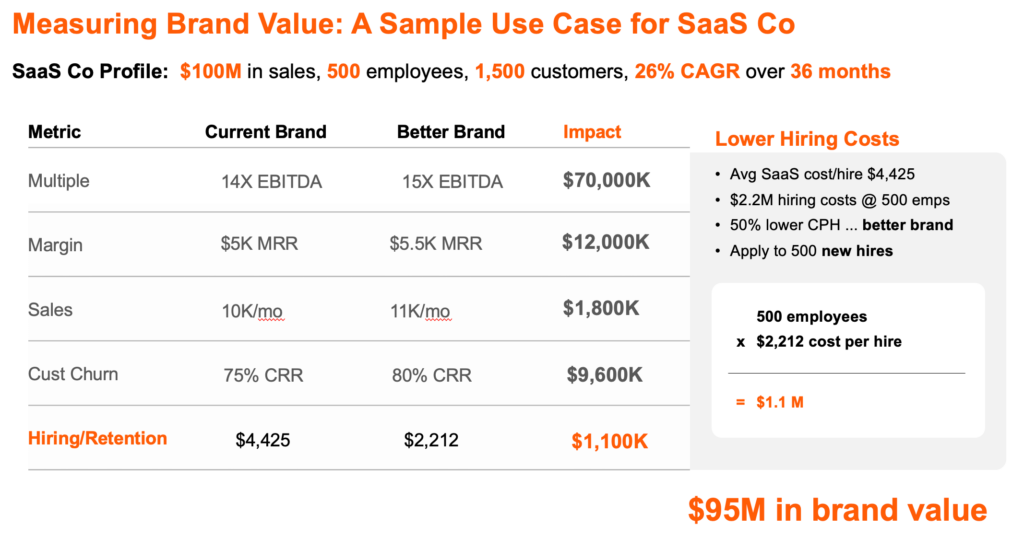

The brand’s impact on valuation

Better brands impact EBITDA and multiples

The brand’s impact on organic growth

Better brands impact sales efficiency, customer retention, and margin

The brand’s impact on talent

Better brands impact cost-to-hire, retention, and productivity

Sources: Ignyte, LinkedIn, Business Insider

How brands impact results

A SaaS company example

The context:

- A $100M SaaS provider is growing 26% over 36 months to $200M.

- The company gets acquired at 5X ARR or 15X EBITDA.

- … for a $1B exit.

Here, we illustrate exactly where and how their brand was key to driving value.